Abstract

This paper outlines the evolution of the MultiversX economic model, transitioning from a capped-supply model to a tail-inflation model with a burn mechanism. This new design is engineered to ensure the network’s long-term security, and stimulate vigorous network growth. The proposed changes target a set of concrete and instrumental outcomes: (a) attract new liquidity, (b) increase network usage, (c) generate material revenue at the protocol level, (d) create an economic model to drive reflexive value accrual and (e) forge a direct, unbreakable link between network utility and a perpetual demand for EGLD.

Preamble

MultiversX is lean, possesses runway for several years of operations, and is among the most technologically advanced Layer 1 blockchains. Yet, every network must evolve to reach its full potential and there are moments when bold, coordinated action can spark significant growth. MultiversX stands at such a moment.

What single, decisive action could set the entire economic engine in motion?

We propose a targeted, milestone-based mechanism to unlock new economic energy across the ecosystem for investors, users, validators, builders, and new entrants:

-

Target 1: Capital Inflow

a. Net new capital inflow: Attract >100 Million USD in net new capital inflow

b. Idle capital conversion: Attract >20% of idle exchange supply and convert it to active onchain stakers

c. Tighten liquid supply: Increase staked capital > 65% to strengthen network security and lower circulating supply

d. Strengthen participation: Increase monthly active delegates > 50,000

e. Boost onchain activity: Channel >30% of staked EGLD into productive yield strategies, compounding ecosystem growth through active participation. -

Target 2: Revenue Growth

a. Revenue engine: Grow network revenue by 100x; begin with a target of $100k/day

b. Entrepreneur growth: Grow number of entrepreneurs to >1,000

c. App growth: Grow number of apps to >1,000

d. Activity and engagement growth: Grow number of monthly active users to 1m -

Target 3: Competitiveness and Reflexive investments

a. Maintain frontier protocol capabilities in terms of speed, bandwidth, revenue

b. Create virtuous economic cycle via buybacks, strategic investments, and real-world asset strategies

Solution mechanisms:

- Introduce a general annual emission rate, which provides a robust budget for (I) competitive staking rewards and network security, (II) active yield incentives, (III) ecosystem and network revenue growth, and (IV) competitive protocol development.

- Couple this with novel fee market structure which directs 90% of base transaction fees to builders, burns the remaining 10%, and opens a priority fee market for validators, meant to drive 10x in revenue and usage.

- Leverage the above with a community-driven growth fund that ensures the long-term alignment of incentives and desired outcomes for builders, users, and investors of the network.

By refining incentives, reallocating resources with precision, and introducing mechanisms that capture and reinvest value, the framework is designed to accelerate liquidity, expand usage, and increase protocol revenue. These outcomes, taken together, establish a durable path for EGLD value accrual and long-term ecosystem alignment.

This is a deliberate evolution: proactive, competitive, and aimed at ensuring MultiversX can scale into new markets and harness new growth for years to come.

The foundational economic model of MultiversX was predicated on a capped maximum supply, a design that effectively established initial scarcity and a clear value proposition. However, for a Layer 1 protocol to achieve true longevity, its economic architecture must guarantee a perpetual security budget. A finite issuance schedule eventually forces a network to rely solely on transaction fees to incentivize validators, a revenue stream that can be volatile and potentially insufficient to secure a global-scale infrastructure.3

Core Principles of the New Model

The new economic framework is built upon two foundational and complementary principles designed to create a robust, self-reinforcing system:

- Robust Perpetual Security: At the core of any L1 protocol is the non-negotiable requirement for unwavering security. The new model commits to a permanent, reliable, and predictable security budget funded by a low, constant rate of tail inflation with a burn mechanism.

- Productive Value Accrual: The second principle mandates a transition from value derived from passive scarcity to value created through active, usage-driven economic productivity. It establishes that all economic value generated by the network’s core functions and protocol-owned applications must be programmatically and transparently channeled back to the native asset, EGLD. This is achieved through a systematic buyback mechanism, creating a direct, quantifiable link between the protocol’s utility and the value of its token. As the MultiversX economy grows, this mechanism ensures that EGLD holders are the primary beneficiaries, transforming every new application and transaction into a source of structural, programmatic buy-pressure for the native asset.

The Economic Flywheel Concept

These core principles combine to create a dynamic system best described as the Economic Flywheel. This flywheel conceptualizes the MultiversX economy as a perpetual motion engine, where each component reinforces the others, leading to compounding growth and value creation. The flywheel operates in four distinct, interconnected stages:

- Secure the Base: The process begins with the foundational layer of long-term economic security. The tail inflation model is designed to provide a constant and reliable incentive for validators, ensuring the network remains robust, decentralized, and trustworthy. This is the bedrock upon which all other economic activity is built.

- Incentivize Growth: With a secure foundation, the protocol aligns the incentives of users and investors to stimulate ecosystem development through an economic partnership with builders. A 90% builder revenue share provides a powerful, direct financial incentive for the creation of high-value, revenue-generating applications. This attracts top-tier talent and capital, fostering a rich and diverse application layer where eGLD is the indispensable unit of account and primary collateral.

- Capture Value: The proliferation of valuable applications and services drives onchain activity, generating a steady stream of protocol revenue. This revenue is captured from a wide range of sources, including transaction fees, token issuance fees, and earnings from protocol-owned liquidity and applications.

- Reinforce the Core: This captured revenue is then programmatically converted into EGLD through open-market buybacks and direct conversion into liquid staked EGLD via transparent, time-weighted, non discretionary open smart contracts.

This flywheel model transforms MultiversX into a self-funding, self-sustaining, and self-reinforcing economic system, designed to thrive and grow in perpetuity.

II. A New Emissions Model: Engine for Security and Growth

To ensure the network’s long-term security and incentive alignment, MultiversX will adopt a tail inflation model with a burn mechanism.

A. Inflation Rate and Burn Mechanism

The protocol will implement a decaying inflation with an increasing burn mechanism. This solution provides a predictable and sustainable budget for critical network functions as well as a new mechanism to attract new liquidity and incentivize long-term capital alignment and growth. This decision is data-driven. Over four years of network operations show a direct correlation between token emissions and measurable ecosystem growth. Conceptually, this model mirrors the successful economic strategies of the 20th and 21st centuries, where growth was catalyzed by directing capital inflows and expansionary policy toward innovation and productive enterprise.

The framework presents an opportunity to enhance sustainability through demand-driven emissions, this introduces a refined emission model starting at a *8.757% maximum theoretic inflation for the first year, adaptively decaying toward a *2-5% floor based on verifiable KPIs including aggregated DeFi activity (TVL and volumes), a 65-70% staking ratio for security, revenue proxied by onchain burns, with moderated weighting to account for volatility. It employs a phased formula that slows decay above 5% during high-growth phases and enables bidirectional adjustments when inflation is under 5%, in order to curve emission according to growth.

*The theoretical maximum can never be reached, as every transaction will burn from the supply, furthermore 40% of the emission is locked in case there is no measurable growth.

KPI Selection and Aggregation for Demand-Driven Adjustments (technical expression)

To make inflation responsive, four KPIs are selected: DeFi activity (aggregated TVL and volumes), staking ratio, protocol revenue via burns, and price growth. These metrics are onchain verifiable, with quarterly evaluations using 3-month rolling averages to smooth volatility.

-

Staking Ratio: Targets 65-70; current ~49-50% (14.2-14.3M EGLD staked, avg APR 6.5%). Score: (Ratio - 50%) / 20%, clamped 0-1.

-

Protocol Revenue via Burns: Burns (10% of base fees) proxy revenue, reflecting transaction-driven deflation. Target >10% QoQ growth; pre-implementation data from Q3 2024 shows stable fees. Score: Growth / 10%, normalized.

-

DeFi Activity: Aggregates TVL (locked capital) and volumes (circulation) to capture ecosystem depth and velocity. Formula: DeFi_G = 0.6 × (TVL_growth / 10%) + 0.4 × (Volumes_growth / 15%), clamped 0-1. As of October 2025, TVL is 80.32M,with 24h volumes 628K and 7d volumes 4.48M. Base case target 250M TVL, 10M 24h volumes.

Composite G = 0.3 × DeFi_G + 0.3 × Staking_G + 0.4 × Revenue_G. This weighting prioritizes ecosystem metrics over market signals, aligning with tokenomics best practices where revenue and activity drive sustainability.

Inflation Adjustment Formula

The model employs a phased decay model, ensuring slow decay in high-growth phases and faster in low, with bidirectional flexibility at lower levels:

- High-Rate Phase (Inflation > 5%):

- Inflation{t+1} = max(5%, Inflation_t - 0.25% × (0.5 + 0.5 × (1 - Growth))).

- Decay ranges from 0.125% (G=1) to 0.25% (G=0).

- Low-Rate Phase (2% ≤ Inflation ≤ 5%):

- Inflation{t+1} = Inflation_t+ 0.5 × (2% + 3% × G - Inflation_t).

- Targets 5% (high G) or 2% (low G), with 0.5 adjustment rate for smoothing.

This design promotes reflexivity: high Growth sustains emissions for incentives, low Growth enhances scarcity via decay and burns. Adaptive burns can increase to 50% when no growth, further countering emission rates.

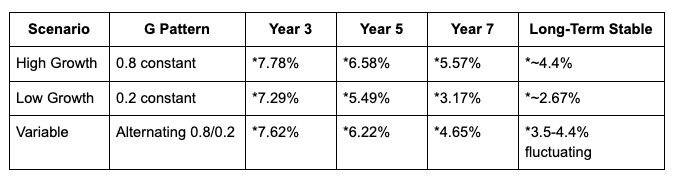

Simulation Projections and Comparative Analysis

Simulations (quarterly, base decay 0.25%) illustrate trajectories:

Table using the formulas to make a set of simulations on the numbers: MVX_Emission_Simulator_INTERACTIVE

*All inflation numbers are maximum theoretical values, actual inflation (how many new tokens enter the chain) is less as the accelerator fund part can be released only if well defined KPIs are met and the burn mechanism of the transaction fees starts.

B. Emissions Distribution Model

The EGLD generated from annual emissions will be programmatically allocated across four key areas to create a balanced and productive economic loop:

APR Calculations of the new model and comparison with the old model: APR Calculation

APR figures are indicative only and may vary based on network participation, governance votes, and market conditions. They do not represent a guaranteed or fixed return.

This distribution model ensures that new issuance is actively channeled to secure the network, incentivize productive network usage, and fund future growth.

Evaluation, rebalancing, governance

Every year, the distribution model is re-evaluated, as well as KPIs and targets will undergo a governance vote to adjust distribution for the next year based on the newest available data. Through this process, allocation buckets can be changed or removed, new allocation buckets can be added, and allocation percentages can be changed based on agreed-upon targets. A full governance vote will take place each year, with an annual report for the existing system publicly shared, recorded onchain, audited, and verified.

III. The Value Accrual Flywheel: Revenue Reinvestment and Fee Burning

The new economic model introduces a sophisticated, dual-pronged approach to value accrual that combines a deflationary fee-burning mechanism with a revenue reinvestment strategy.

A. Updated Fee Market and Burn Mechanism

MultiversX will implement a fee market structure inspired by proven models like that of Ethereum’s EIP-1559, which divides transaction fees into two components: a base fee and a priority fee.7

-

The base fee is a protocol-set minimum fee. It is split as follows:

-

90% to Builders: This portion is directed to the smart contract authors, creating a direct revenue stream for developers. This establishes one of the most competitive builder incentives in the industry.

- When one transaction calls multiple smart contracts, the VM calculates the gasUsed exactly by each of the contracts, and the fees are directed towards each of them according to the gasUsed.

-

10% is Burned: This portion is permanently removed from circulation, introducing consistent deflationary pressure that is directly proportional to network activity.

-

Every year, the base fee structure changes, builders get 5% less, 5% more is burned. This is done for 8 consecutive years, resulting in a split of 50% to builders, 50% to burn.

-

The split of the fees will be additionally re-evaluated every year via a governance vote. Audits and reports will be created for each item to determine whether KPIs were reached or not.

-

The base fee from transactions which do not call smart contracts (asset transfers, data transfers, recording data) will be burnt completely.

-

The fees for the failed transactions are completely burnt, both base fee and priority fee.

-

Priority Fee: An optional fee paid by users to incentivize faster transaction inclusion. This entire fee is paid directly to the validators (10% to the leader, rest to the consensus members), rewarding them for their role in processing transactions and creating a competitive market for blockspace that directly reflects the real-time economic demand for the network’s processing power. This clearly targets more revenue for validators and more opportunities for validators to build more. With growing revenue, the validators can choose to lower the fees on the staking provider side, creating benefits for the users, to share the fees with users, or to deploy those into DeFi.

- The shard split algorithm takes into consideration multiple parameters. Available block space, used block space, pending validators in the auction list. This indirectly means that creating new shards happen only when that makes sense economically for all the actors in the network and when there is demand for bigger blockspace. Because of sharding priority fees are never too high, users enjoy the dApps at the lowest cost.

The scope of this structure thus creates a powerful dual-engine for value: builders are incentivized to create utility that drives transaction volume, and every single one of those transactions permanently increases the scarcity and baseline demand for EGLD. The 90% share of the fees to builders opens up a new set of applications and user experience, encouraging builders covering transactions free (through relayers) for their users. This share is meant to enable the creation of high frequency apps, activities, and bots, as the chain’s architecture provides sufficient block space. When blocks are full, validators can capture additional rewards from the priority fees.

*The capacity of the blockchain after the SuperNova upgrade is 1Billion Gas per seconds. Filling up one shard with smart contract transactions in one day costs 864 eGLD, which would yield 86.4eGLD in burns per shard, thus the cost is high enough for deter attacks. In year 8, it would be 432 eGLD burnt per day per shard.

B. Protocol Revenue Reinvestment Strategy

All revenue generated by the protocol is used to programmatically acquire and stake more EGLD. This creates a sovereign economic engine that perpetually strengthens the network’s security and capital base.

This mechanism functions as a self-reinforcing loop:

- Revenue Capture: The protocol treasury captures revenue from various sources (e.g., fees from protocol-owned applications, a portion of ESDT issuance fees).

- Acquire and Stake: Non-EGLD captured revenue (e.g., in USDC) is used to buy EGLD on the open market. This EGLD is then staked. Buyback is done programmatically via Smart Contracts, different fees are accumulated, and the only way to use those is via buying back eGLD from the open market.

- Liquid Staking: To maximize capital efficiency, the staked EGLD is converted into a Liquid Staking Derivative (LSD) token. This LSD represents staked EGLD, accrues staking rewards, and can be used in low-risk yield strategies to increase returns. It effectively transforms the protocol’s own treasury into its largest and most active DeFi participant, creating a perpetual, sovereign demand engine that constantly works to strengthen the EGLD market

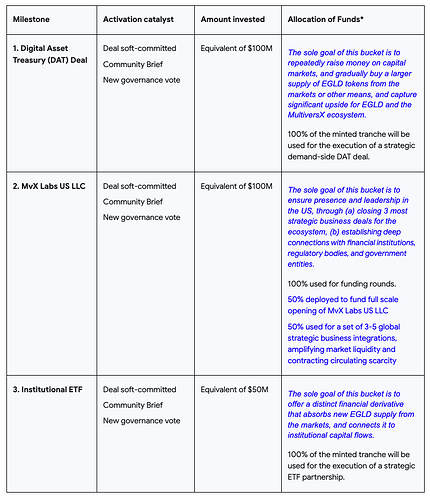

IV. Catalysts for Growth: The Accelerator

The emissions distribution model establishes two powerful, community-governed funds to accelerate ecosystem growth and the protocol development fund. The funds go into open sourced, labeled DAO smart contracts and the tokens are released based on the well defined KPIs and exact formulas programmatically and only when the DAO members sign that the KPIs are met.

Decisions concerning the allocation of strategic emissions are inherently objective and tied to measurable network growth. The structure of the DAO, including the DAO member election and process definition, will be voted via full governance by all EGLD stakeholders. To ensure impact-driven allocation, the tokens designated for the Accelerator funds (Ecosystem Growth and Growth Dividend) are programmatically locked if there is no measurable growth. Emissions are released only when builders/DeFi strategies demonstrate impact by achieving predefined, onchain verifiable Key Performance Indicators (KPIs) related to metrics like active users, transaction volume, and TVL.

A. Ecosystem Growth Fund for Builders (20% of Emissions)

This fund is dedicated to nurturing the developer ecosystem. A DAO, governed by EGLD stakeholders and operating under the oversight of MultiversX Foundation, will oversee the distribution of these funds through a structured grants program. Funding decisions will be tied to clear, measurable Key Performance Indicators (KPIs) to ensure accountability and impact-driven allocation. The underlying philosophy is simple: protocol emissions must be used to fund the creation of applications that, in turn, create sustainable, long-term demand for EGLD.

Example KPIs for grant recipients could include:

- User Adoption: Monthly active users, new wallet creation.

- Onchain Activity: Transaction volume, smart contract interactions.

- Economic Impact: Total Value Locked (TVL), protocol revenue generated.

- Community Growth: Social media engagement, developer onboarding.

The underlying goal is to fund applications that create sustained demand for EGLD. To ensure emissions are utilized productively, several guardrails are added. Milestone based grants and Lock mechanism.

Milestone based grants as used in growth games is a proven method where builders and the protocol are aligned and strict timelines and KPIs are proposed, signed and verified at each milestone. If a milestone is not reached, the further grants for the project are locked, until those are met, or restructured to other builders.

Lock Mechanism for unused tokens is triggered by failure to meet predefined KPIs, thereby tying allocations to verifiable network growth. Oversight by the MultiversX Foundation and EGLD stakeholders via DAO ensures transparency and accountability:

- Trigger Conditions: If no qualified grant applications are received in a quarter, or if recipients fail to achieve at least 80% of targeted KPIs (e.g., <10% QoQ growth in TVL or transaction volume), the unused tokens are locked for future usage.

- Lock Calculation: Unused tokens = Allocated emissions - Distributed grants. Lock 100% of unused tokens at quarter-end, prorated if partial KPIs are met (e.g., 50% lock for 50% KPI achievement).

- Process: DAO reviews applications and performance reports; locks executed via smart contract. If demand exceeds supply, locked tokens roll over to the next quarter.

This ensures emissions are released only when builders demonstrate impact, preventing wasteful allocation and promoting high-quality projects.

B. Growth Dividend Fund for Users (20% of Emissions)

The Growth Dividend represents a new mechanism to reward network users for their participation in the network economy. For this, the MultiversX economic model distinguishes between two fundamental activities: Simple Staking and Active Yield Strategies.

- Simple Staking is the foundational layer of network security. It is a passive activity where users delegate their EGLD to validators, contributing to the consensus mechanism and earning a baseline reward for their participation. This is essential for the network’s stability and integrity.

- Active Yield Strategies, in contrast, represent a dynamic and high-yield paradigm for onchain participation. This framework is designed to transform the capital securing the network into a powerful engine for economic growth - a departure from legacy models where staked capital remains economically inert. It achieves this by channeling a portion of the emissions (20%) to incentivize users who deploy their staked assets in DeFi strategies. These strategies are explicitly designed to increase EGLD’s utility, onchain velocity, and direct market demand. Users deploying their capital to participate in such productive activities will be rewarded directly via a Growth Dividend. Any user will be able to participate in the active yield strategies, via one-click solutions, from low to high risk DeFi activities, open source, permissionless, trustless.

Like the Ecosystem Growth Fund, this Growth Dividend Fund is managed and overseen by a DAO governed by EGLD stakeholders. To participate, no specialized knowledge is required on the user end. By simplifying access to yield, the Growth Dividend Fund aims to convert the network’s entire staked supply into a potential source of active liquidity, creating an immense and readily deployable capital base that programmatically drives demand for EGLD within DeFi.

The underlying goal is to fund applications that create sustained demand for EGLD. To ensure emissions are utilized productively, several guardrails are added. The bucket incentivizes deploying staked EGLD into DeFi to boost utility, velocity, and demand, accessible via one-click, permissionless solutions, which drives back direct revenue to EGLD. One-click solution to migrate from staked eGLD to active strategies will be developed as well.

Safeguarding the Ecosystem: Open source, audits, security

To ensure that the rewards program supports only high-quality, secure protocols, a clear set of criteria must be met for any LST, DEX, Lending or other DeFi protocols to qualify for the boost. This directly addresses the need to ensure LSTs are in good hands.

Basic Criteria for Participating Protocols:

- Fully Open-Source: All code must be publicly available for review.

- Professionally Audited: Must have undergone and passed rigorous security audits from reputable firms.

- Secure Upgradability: All contract upgrades and privileged owner calls must be controlled by a Multi-Signature (MultiSig) wallet, preventing unilateral control by a single entity.

Clear alignment of economics: auto flywheel mechanics of preserving revenue in a decentralized and transparent way, funds to stay on chain, to have a treasury contract, extractive mechanics can be penalized by the DAO and suspend distribution

These criteria establish a high standard of security and decentralization, protecting users and the network.

The Core Principle: Boosting New Liquidity, Not Staking

Staked EGLD or LSTs act as a prerequisite—a key to unlock rewards on a separate, vital contribution. The boost is a reward calculated on the new, external capital (like USDC or wBTC) that a user brings into the DeFi ecosystem or how he uses other capitals in DeFi and how many DeFi activities he does.

- Analogy: Think of your staked EGLD/LST as your membership card to an exclusive club. The card itself has its standard benefits (base staking rewards). The “boosted rewards,” however, are earned only when you use that membership to bring a valuable guest (your USDC/wBTC liquidity) to the party.

Example: If you have 1,000 EGLD staked and separately supply $10,000 USDC to an approved lending pool, you will receive boosted rewards calculated on the amount of EGLD equivalent to that $10,000. The boost is for the USDC, which is a critical component for a thriving DeFi ecosystem. The one-click strategies can be made in such a way that one person brings the staked eGLD, the other person brings the external capital and the boost if split between the two, as an example.

Lock Mechanism for unused tokens is triggered by failure to meet predefined KPIs, thereby tying allocations to verifiable network growth. Oversight by the MultiversX Foundation and EGLD stakeholders via DAO ensures transparency and accountability::

- Trigger Conditions: Lock activate if DeFi strategies fail to maintain stables and BTC in active positions at least equal to the value of Liquid Staked eGLD (e.g., stables/BTC TVL ≥ Liquid Staked eGLD value), or if Liquid Staked eGLD does not grow QoQ (e.g., <5% increase).

- Lock Calculation: Unused tokens = Allocated emissions - Distributed dividends. Lock 50-100% based on shortfall severity (e.g., 50% for partial mismatch, 100% for no growth or severe imbalance), assessed at quarter-end.

- Process: DAO monitors on-chain metrics (e.g., TVL in stables/BTC pools vs. Liquid Staked eGLD); locks via automated smart contract. Eligible users claim dividends proportionally to their DeFi contributions.

This ties rewards to ecosystem liquidity, converting staked capital into active economic drivers while locking idle emissions to maintain scarcity.

Overview of exemplary Active Yield Strategies: A Catalogue of Active Yield Strategies

C. Protocol Sustainability (10% of Emissions)

This fund is dedicated to core operations and fundamental advancements of the MultiversX protocol. The primary goal of this bucket is to ensure protocol competitiveness by funding a world-class engineering team and a research and development department. This crucial investment aims to place the network at the frontier of innovation. The funds already go into the labeled multiSignature contract, this part remains as it was from the genesis, and it will receive transparency reports on how it is used. The technical development roadmap for the next releases after Supernova will be shared and followed and re-evaluated every quarter.

The Foundation systematically ensures proper management and accountability through concrete reporting mechanisms and community involvement. Specifically, it:

- Establishes guardrails in collaboration with stakeholders: category caps, SLOs/SLA targets, audit cadence, and lock/rollback conditions.

- Submits plans for community review: presents its quarterly/annual Sustainability plan to the community for feedback, assessing it against the approved guardrails and KPIs to ensure alignment.

- Monitors delivery with constant oversight: tracks execution (roadmap, audits, incident response, infra SLOs), publishes detailed dashboards and quarterly reports for transparency, and recommends locks/reallocations for stakeholder vote if thresholds aren’t met.